List of Approved Outlets. Here is a list of tax codes that are.

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

List of Sundry Goods.

. Guide on Accounting Software. There are 23 tax codes in GST Malaysia and categories as below. For more information about tax code properties see Tax Code Properties.

MYOB Price List Malaysia MYOB Payroll Free MYOB Preview MYOB AccountEdge How to buy MYOB MYOB Training MYOB Support MYOB Implementation MYOB RetailManager MYOB Premier MYOB Accounting Free MYOB download. In the service tax no input exemption mechanism is. Malaysias total trade hits new high of RM2704bil in June The Star Online.

GST Tax Codes in MYOB. The access to the tax code list menu is the same for both MYOB Accounting and MYOB Premier. Lmports under special scheme with no gst incurred e9 approved trader scheme atms.

Treatment of input tax attributable to exempt financial supplies as being attributable to taxable supplies. Output Tax 0 - Zero Rated Supplies to Designated Area. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10.

Monthly Tax Deduction MTD 6. Malaysia GST Reduced to Zero. GST code Rate Description.

Capital acquisition GST item. GST on purchases directly attributable to taxable supplies. Supply of goods and services made in Malaysia that accounted for standard rated GST.

A GST registered supplier can zero-rate ie. The sac is strictly numeric and is six. Jabatan Kastam Diraja Malaysia Appendix 2 - Guide to enhance your accounting software to be GST Compliant Draft as at 13 March 2014 TX.

This tax is not required for imported or exported services. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. The bank will provide a GST invoice to you and you can claim the GST input tax.

The Amnesty scheme will be applicable for all pending. Accounting for GST. Meaning of longer period.

The two reduced SST rates are 6 and 5. GST code Rate Description. We will get it fixed as soon as possible.

Knowing the structure of the GSTIN is crucial for a business - to ensure that ones suppliers have quoted the. For more information regarding the change and guide please refer to. For purchases with input tax where the GST registered entity elects not to claim for it.

Exempt GST print code Specify the print code that is used for exempt GST codes. GST State Code List of India. Sorry for the inconvenience.

Examples includes sale of air-tickets and international freight. SST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system. Malaysia GST Reduced to Zero.

Service Tax is charged on a specific service provided by a taxable person in Malaysia carrying out a business. 6 a list of the gst reliefs is available in the gst imports relief order. The Service tax is also a single-stage tax with a rate of 6.

While migrating to a GST registration or while going for a new registration most businesses would have received the 15 digit provisional ID or GSTIN Goods and Services Tax Identification Number. Azmin says Malaysias trade rose to RM215b in June 2022 highest since RCEP kicked in Malay Mail. GST Guidelines on TRS.

The Malaysia Standard Industrial Classification MSIC search engine system or e-MISC was developed to facilitate the users to find the relevant industrial code. Income Tax Payment excluding instalment scheme 7. 1 Government Tax Code.

Search by MSIC 2008 Code Please insert at least 3 digits. Real Property Gain Tax Payment RPGT 5. Attribution of input tax to taxable supplies.

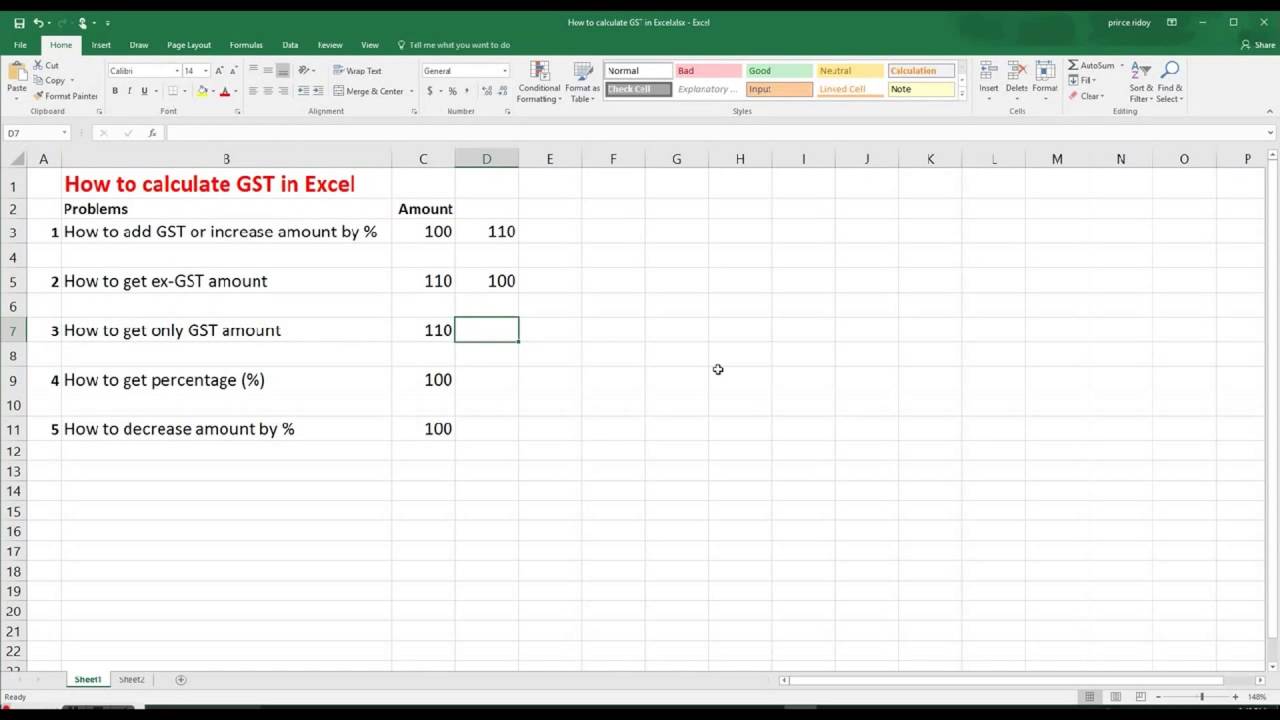

The tax codes list window displays all the GST codes available in MYOB. It applies to most goods and services. To view the GST Tax Codes in MYOB open your company file then click on Lists Tax Codes as shown in the image below.

Gst is levied on most transactions in the production process but is refunded. The tax codes list window displays all the GST codes available in MYOB. Claim for input tax.

Non-applicability to certain business. Here is a list of GST codes and terms that comply with the Australian BAS. Explanation of Government Tax Codes For Purchases.

Yes if the purchase was made 3 months before the tourist departs from Malaysia. To understand how NetSuite uses the tax codes to get the values for the Malaysia GST-03 Return see What goes into each box - Malaysia GST-03 Return. In the meantime you can go to our home page or use our help centre.

Charging GST at 0 the supply of goods and services if they export the goods out of Malaysia or the services fall within the description of international services. Disallowance of input tax. Malaysias total trade exceeds RM2 trillion exports imports at new high New Straits Times.

Gst tax code list malaysia 2017 52022 dated March 25 2022 unveils an Amnesty Scheme 2022 to settle outstanding tax dues pertaining to the period before GST introduction. Examples of zero-rated supply as prescribed based on tariff code in GST Zero-rated Supply Order 2014. On the Tax Code page check the boxes of the properties that apply to the tax code.

For example you make payment to vendors and you must also pay bank fees to banks. The MSIC 2008 version 10 is an update of industry classification developed based on the International Standard of Industrial Classification of All Economic Activities ISIC Revision 4. Per Malaysia GST regulations GST will be applied to the bank charge.

Input tax on purchases made from GST registered suppliers by local authorities or statutory bodies to perform regulatory and enforcement functions. Purchases with GST incurred at 6 and directly attributable to taxable supplies. Malaysias exports at record high total trade surpasses RM2 tril in 2021 Free Malaysia Today.

GST List of Zero-Rated Supply Exempted Supply and Relief in Malaysia. Capital acquisition GST free item. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting electricity.

938 ap bad debt relief calculation for im tax code.

Chanel Sales Gst Black Caviar With Gold Hardware With Card Condition Good Rm 5990 Cash Price Promotion Only For Our Followers And Available At 114 Jalan

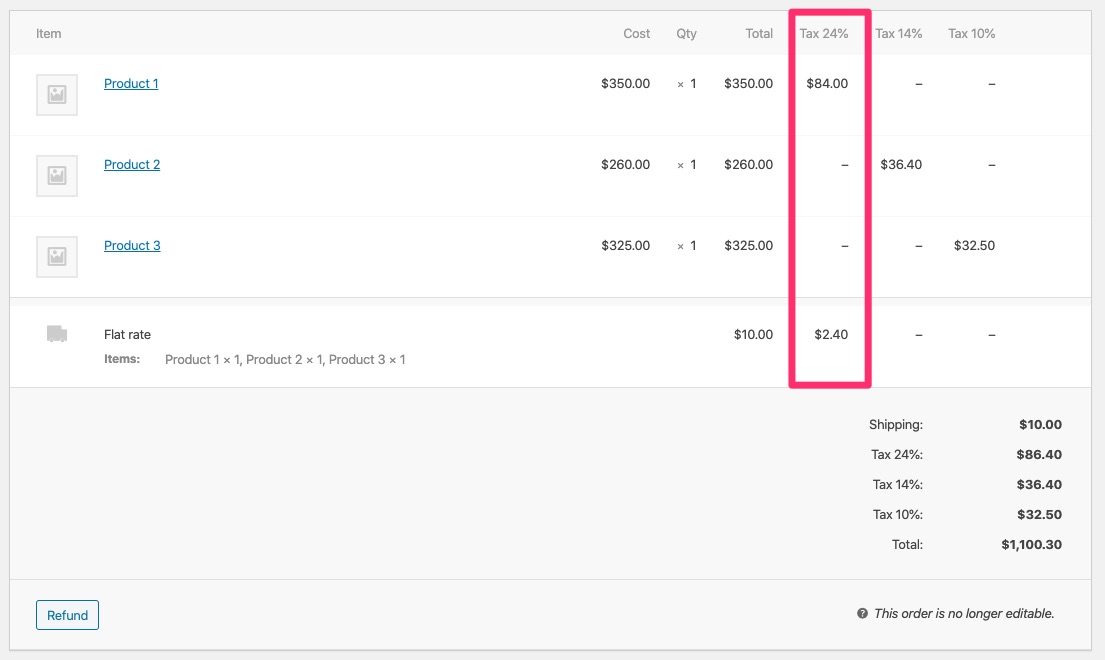

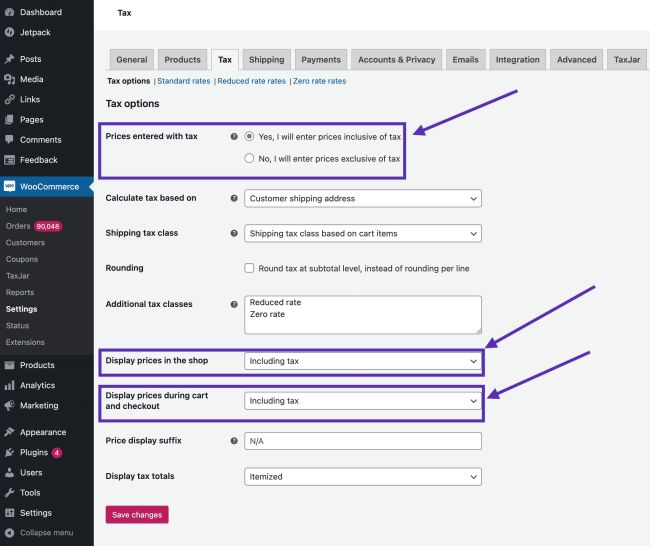

Setting Up Taxes In Woocommerce Woocommerce

Ibm Retains Leadership Position In 2017 Gartner Magic Quadrant For Application Security Testing

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

Setting Up Taxes In Woocommerce Woocommerce

Setting Up Taxes In Woocommerce Woocommerce

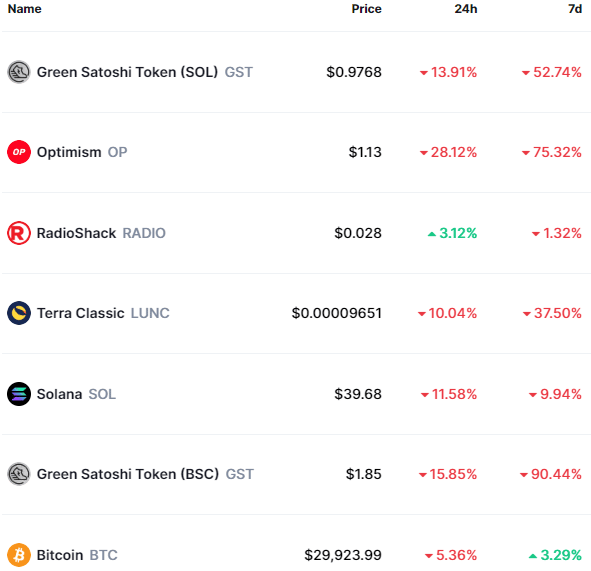

Green Satoshi Token Price Drops What Is Gst

Gst State Code List 2022 Pdf Download Free

Casio G Shock Gst B200tj 1ajr G Steel Series 4549526268533 Ebay Casio Casio G Shock G Shock

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

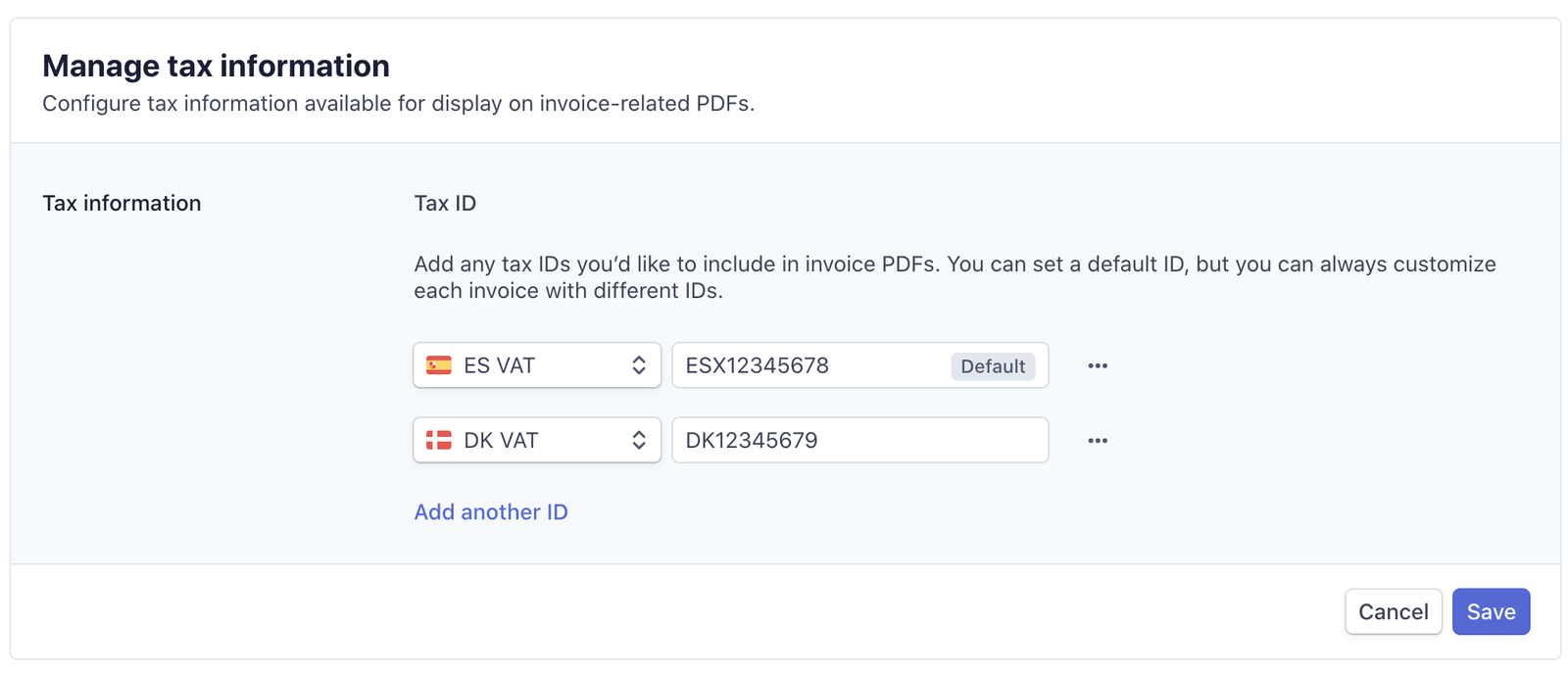

Account And Customer Tax Ids Stripe Documentation

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters

How Do Housing Developers Get Money To Build Houses Propertydeveloper Fund Property Bridgingloan E Building A House How To Get Money Property Development

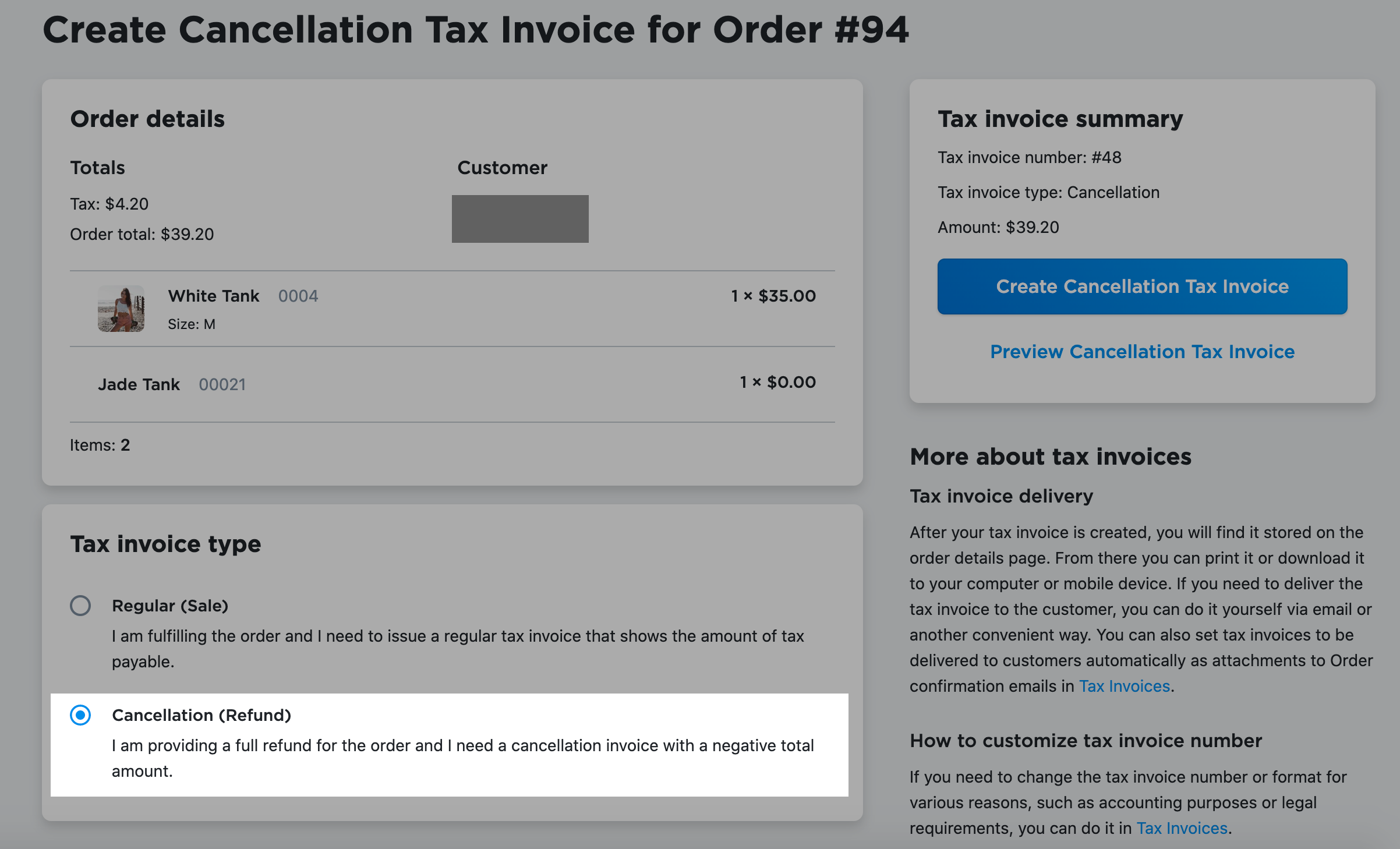

Creating Tax Invoices Ecwid Help Center

The Art Of Mapping Products With Tax Engine Commodity Codes

Customer Tax Ids Stripe Documentation

Make Sense Of Your Sales Tax Across The Us And Canada 2022